Roll over 401k to roth ira tax calculator

This means that there are tax consequences if you rollover a 401 k to Roth IRA. This calculator assumes that your return is compounded annually.

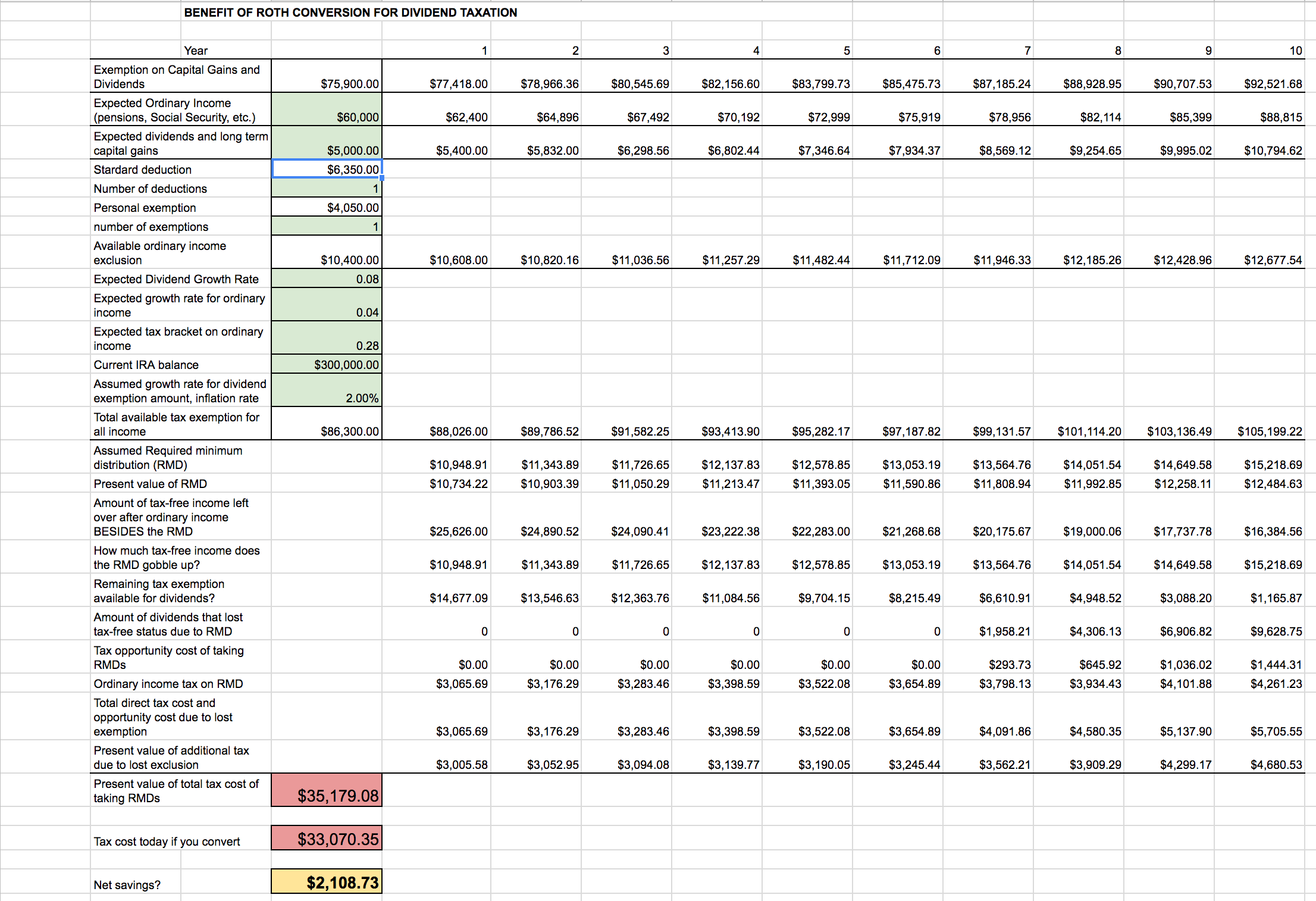

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

No taxes will be imposed on rollovers.

. It increases your income and you pay your. As of January 2006 there is a new type of 401 k -- the Roth 401 k. Use this free Roth IRA calculator to find out how much your Roth IRA contributions could be worth at retirement calculate your estimated maximum annual contribution and find out what.

This calculator can help you decide if converting money from a non-Roth IRA s including a traditional rollover SEP or SIMPLE IRA to a Roth IRA makes sense. It is mainly intended for use by US. Roth IRA Conversion Calculator â Use this calculator to compare the projected after-tax value of your Traditional IRA or 401k to the projected tax-free value of the same funds in.

Both Roth and traditional IRAs generally offer more. When you convert from a traditional IRA to a Roth IRA the amount that you convert is added to your gross income for that tax year. 800000 or 80 is pre-tax.

For the Roth 401 k this is the total value of the account. Well walk you through the important considerations before initiating a Roth IRA conversion. For the traditional 401 k.

Use our Roth IRA Conversion Calculator Use our. Hypothetical Value at Retirement Age after Taxes Traditional 401 k and After-Tax Amount Invested. Because a standard 401 k is funded with before-tax dollars you will need to pay taxes on.

Call 866-855-5635 or open a Schwab IRA today. Roth IRA Rollover Calculator Use this Roth IRA rollover calculator to project the inflation-adjusted after-tax value of your Traditional IRA or 401k at retirement versus the inflation-adjusted tax. A Roth conversion is an optional decision to change part or all of an existing tax-deferred retirement plan such as a 401 or a traditional IRA to a Roth IRA.

The Standard Poors 500 SP. This calculator compares two alternatives with equal out of pocket costs to estimate the change in total net-worth at retirement if you convert your per-tax 401 k into an after-tax Roth 401. The actual rate of return is largely dependent on the types of investments you select.

You can contribute up to 6000 to a Roth IRA with a 1000 catch up if. Lets look at a hypothetical example of a 401 k rollover to a Roth IRA. Traditional 401 K Or Roth 401 K Calculator Calculate your earnings and more A 401 k can be an effective retirement tool.

A rolloverconversion of after-tax 401 k money to a Roth IRA is tax free. Lets assume Andrew is age 60 retired and has 1 million in his 401 k. It is also possible to roll over a 401k to an IRA or another employers plan.

Roth IRA Calculator This calculator estimates the balances of Roth IRA savings and compares them with regular taxable savings. Roll Over 401K To Roth Ira Tax Calculator A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the. September 26 2021 142 PM.

Have the 401 k trustee do a direct rollover to the Roth IRA. For 2022 you can contribute up to 20500 to a 401 k with a 6500 catch up if youre 50 or over.

Traditional Vs Roth Ira Calculator

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

What Is The Best Roth Ira Calculator District Capital Management

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Calculator Roth Ira Contribution

How To Convert Traditional Ira Funds To Roth Solo 401k

401k Rollover Calculator To Roth Traditional Sep Or Simple Ira

Traditional Vs Roth Ira Calculator

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Conversion Spreadsheet Seeking Alpha

Roth Ira Calculators